A note from editor Becky Kane: It's really hard to make progress on your other goals when you're stressed about money. It may seem counterintuitive, but budgeting has helped me think about money less, freeing up precious mental space for the things that are important to me.

I've been using YNAB (short for You Need a Budget) almost as long as I've been using Todoist, so when the opportunity arose to partner up and help our readers organize their finances, I jumped at the chance. I've experienced the productive power of budgeting in my own life, and I hope this guide helps you do the same, in 2024 and beyond.

With that, I'll turn it over to Ben from YNAB...

Sometime during the summer of 2017, I woke up to realize that my life had become pretty complicated. Don’t get me wrong, I had a good life. In fact, things had improved dramatically in the prior years. I had started my job at YNAB teaching people how to budget, which not only gave me meaningful work, but let me work from home! I had settled into a new house. I welcomed my second child into the world.

Yes, my life had gotten better, but there was also a lot more to do. There was always something to clean or a small human who needed a snack. And it wasn’t so much that I had too much to do. It was that I was constantly thinking about everything I had to do. The mental load was exhausting.

That’s when I first discovered Todoist. With time, and a little trial and error, I was able to put all these things in order. Not only was I able to get everything done, but I didn’t have to think about all the things I had to do anymore. And that made all the difference: Todoist freed up my valuable mental space, and I am eternally grateful.

You might be someone with the opposite problem: you’ve already brought order to your daily tasks thanks to Todoist—but for you, managing your money still feels like an exhausting, draining mess.

There’s some good news: you can take the same systematic approach you’ve learned with Todoist and apply it to your financial life. Follow these steps to build a budget, free up your valuable mental space, get a handle on your finances, and finally have a tool to reach your financial goals.

Setting up your budget

Making a budget is the first step of financial control. Your budget will create a reliable system to finally get all those money details out of your head and into tangible form, and it will give you clarity when making financial decisions, big and small.

1. Choose your budgeting tool

What will you use for your budget? You’ll want something that’s flexible, interactive, and can handle some basic math. Most importantly, you want a tool you’ll use day in and day out. You can use anything for this list: pen and paper, a spreadsheet, or a budgeting tool (you can check out a free trial with YNAB to make some of these steps a lot easier). No matter the tool you use, the same basic steps apply.

2. List your monthly expenses

Go through credit card statements, bank account transactions, your Amazon orders in the past year — the whole nine yards to jog your memory for the things that you actually spend money on. Don’t worry about amounts yet. We’ll get to those next.

Here are some examples of monthly expenses you’ll want to include:

- Rent/mortgage

- Utilities

- Gas

- Groceries

- Internet

- Phone bill

- Monthly debt payments

3. List your non-monthly expenses

Those bills that used to catch you by surprise? Not anymore! Add in non-monthly and irregular expenses like:

- Holiday gifts

- Car insurance

- Home repairs

- Your phone that will eventually need to be replaced (hang in there battery life!)

Check out this list of more non-monthly expenses you might want to add to your budget.

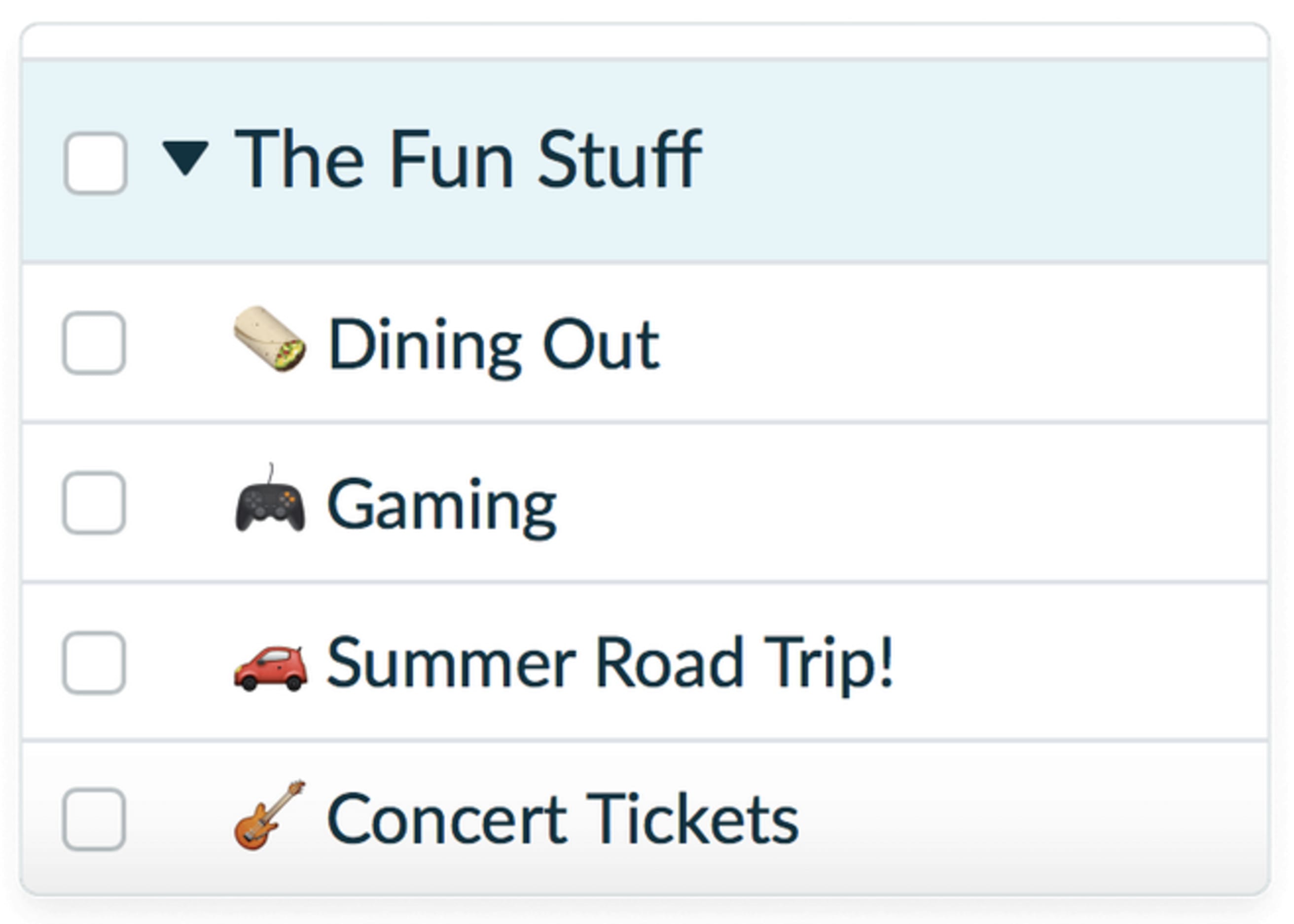

4. List your savings goals

Budgets aren’t meant to be limiting — quite the opposite in fact! Those big-ticket items you want? Your budget should reflect those too. Here are a few examples:

- The couch that will make you feel like an adult

- A bigger emergency fund

- A vacation (somewhere, anywhere!)

- A kitchen renovation

- Funding a retirement account

- Funding a kid's college savings plan

- A down payment on a house

We recommend focusing on just a few savings goals as you’re first starting. You’ll build momentum soon, don’t worry.

5. Add a “Stuff I Forgot to Budget For” category

This tip helped me out a ton when I first started budgeting. You will forget stuff at first, and adding a “Stuff I Forgot to Budget For” category builds in a nice little safety cushion so you aren’t caught unaware.

6. Write down monthly needs in each category

Here’s where the actual dollars and cents come in. For each category you listed out in step one, add in how much money you need on a monthly basis. This can be tricky, especially if you’ve never tracked your spending before. It’s usually better to start high and work on cutting back on certain categories later. Try to be as honest and realistic as you can.

For non-monthly expenses like holiday gifts, simply divide your estimated cost by 12 to get a monthly amount. It’s totally okay to ballpark an amount here—“I want to save $50/month for my next phone or laptop” — you’ll be able to adjust and learn as you go.

When you get to your savings goals, it’s okay to guess here. Maybe you want to save $200/month to an emergency fund and $100/month for a road trip vacation this summer — just add an amount and adjust in the next step.

7. Find the monthly total you need

Add up the amounts in your list to find the monthly total you need to cover your expenses and savings goals. Compare that number to your expected monthly income. If your total is more than what you expect to bring in in a month, find places to cut back — you might tweak some of those savings categories, or take a harder look at some of your other expense categories. Keep trimming back until the amount you need is less than the amount you bring in.

If your income varies from month to month, look at what you’ve brought in over the past year and try to come up with a baseline monthly number. Or, ask yourself, “What’s the least I could expect to bring in in a given month?” Adjust your expenses from there so you’ll have a nice safety margin built in.

8. Add up your available cash

Gather together all your liquid cash accounts — your checking accounts, savings accounts, the cash in your wallet, the change under your couch cushions (joking, unless you really want to). Add it all together in one big pot.

See that amount? That’s the money you have right now to allocate to each expense category. If you don’t have a lot of money, that might seem incredibly disheartening at first glance, but hang in there. You’ll see shortly how this setup offers powerful clarity in the next steps.

At YNAB, we believe your budget should be based on the actual money you have today, not money you may or may not have in the future. This mindset can take some getting used to, but it’s the surest way of making sure your budget is aligned with your current reality.

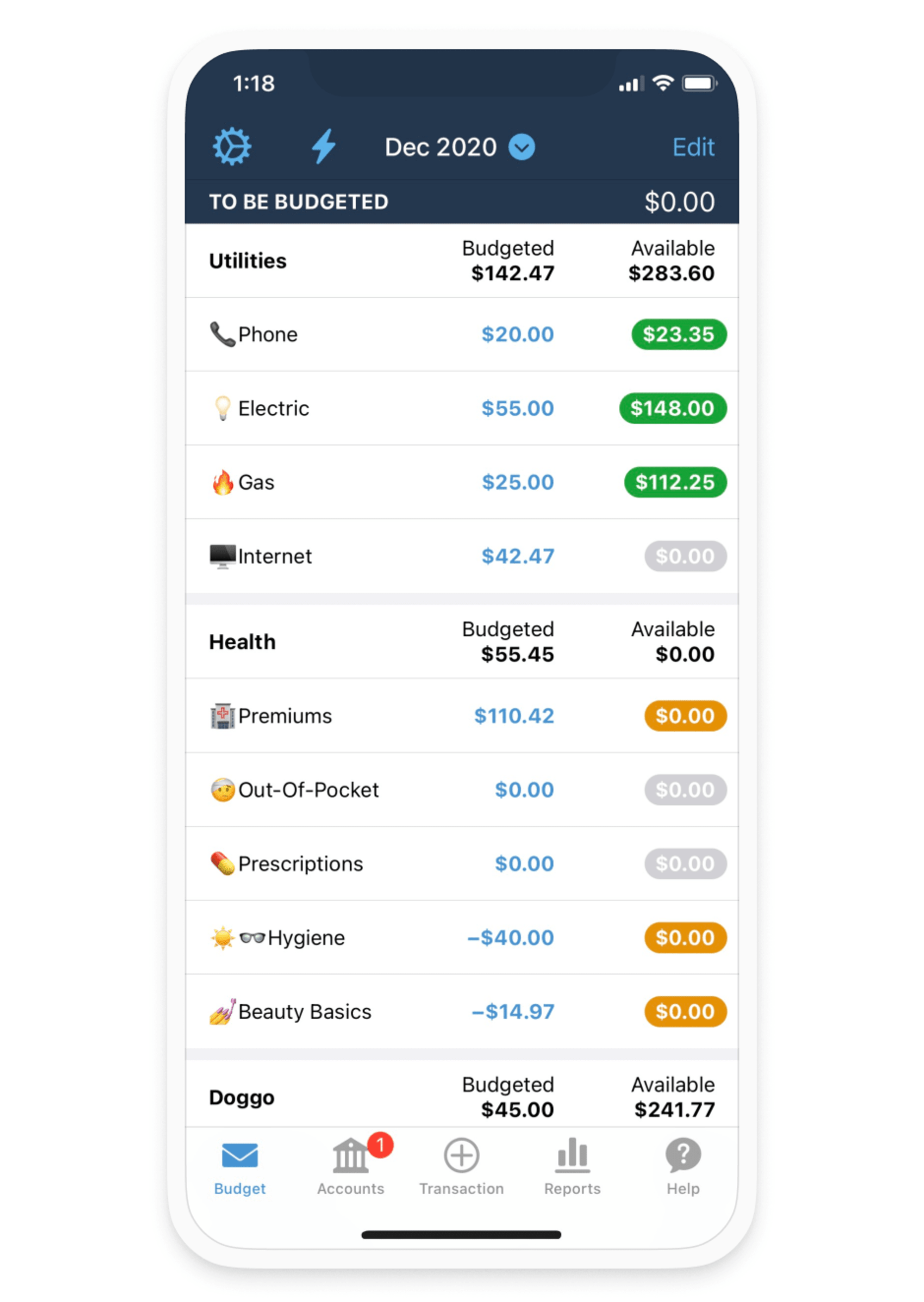

9. Assign money to categories

Now, go back through your list of categories from Steps 3-5 and fill up the amounts needed with the money you have on hand from Step 8. This step is like using the cash envelope system but in the digital realm: you take the money you currently have and stuff each “envelope” or category until all your money has been earmarked for a purpose. This is where YNAB or any zero-based budgeting app becomes especially useful, but adding another column in a spreadsheet that calculates your running total will do the trick here — or simply using a calculator alongside your pencil and paper.

You might not have enough money right now to cover every single one of your monthly and non-monthly needs. That’s okay. When more money comes in, you’ll assign money again (and not a moment sooner!).

On the flipside, you might have more than enough money right now to cover your monthly budget. Start funding your categories for next month to create a one-month cushion in your budget, or add more to your current savings goals. Either way, we want you to have a crystal clear picture of your finances. That means dealing in your current reality and only the money you have on hand right now.

10. Celebrate! 🎉

You officially have a budget! You’ve faced your financial reality head-on and you’ve come out the other side. A lot of people never get this far — it’s an accomplishment worth celebrating!

Even if your financial picture isn’t as rosy as you’d like, you’ll likely feel an instant sense of relief or at least clarity instead of vague dread when you think about your money. Seeing the big picture of your finances is the first step to taking control of them. You’ve just created a map to guide your spending decisions, and you’ll know with confidence that each month you’re getting a little further ahead rather than further behind. You’ve now created the foundation for your system to free up more mental space and finally stress less about money.

Making the budgeting habit stick

Just like your lists in Todoist, your budget is meant to be referenced frequently and adapt with your changing priorities. It’s not a set-it-and-forget it thing — but you’ll find that, with just a little time each day of active effort to manage your budget, good habits will take root. You may be surprised to find that budgeting helps you spend less time worrying about your finances, not more. Here are a few habits we see with successful budgeters:

- Check your budget (not your bank account!) before spending. [daily] Before you buy the latest thing on Amazon or try to decide if today is a day for Starbucks, take a quick glance at your budget for instant decision-making confidence ($15 left in the coffee budget? Double shot espresso coming right up!). If you’re using YNAB, this is where the mobile app comes in handy.

- Use your budget to buy fun things. You want to make budgeting an attractive, enticing habit. Make sure you have categories you can get excited about—whether that’s date nights, a monthly book allotment, or a category that’s simply earmarked for “Fun Money.”

- Track your spending. [daily] What gets measured gets managed, and tracking your spending is a simple way to be more mindful of where your money goes. I know this sounds like a daunting task if you’ve never done it before, but if you do a little every day, it actually only takes a few minutes. And there are a ton of tools out there (like YNAB!) to help make this easy.

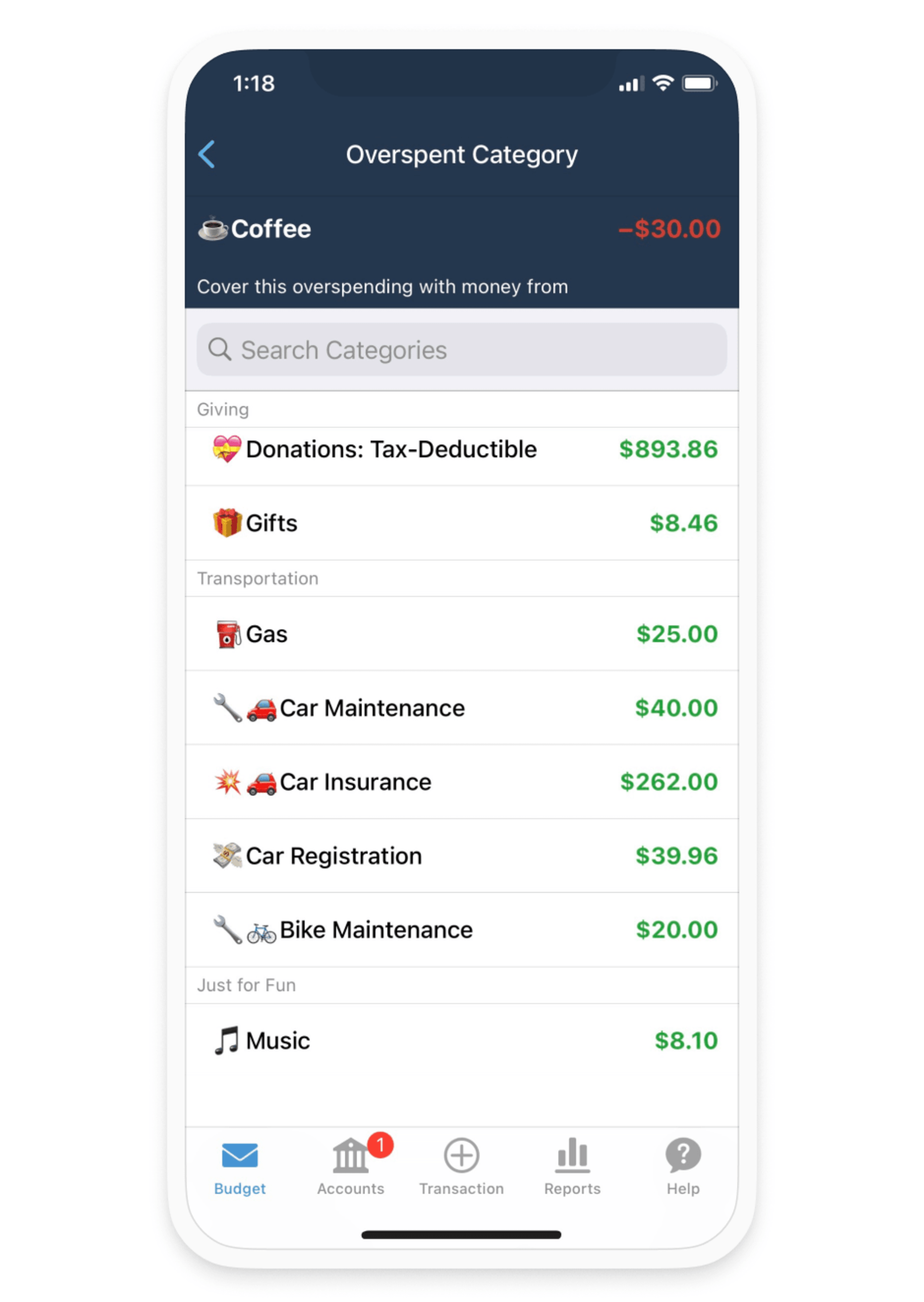

- Move money to cover overspending. [daily] Make sure your budget bends rather than breaks. Perhaps the Amazon Prime membership came due sooner than anticipated: move money from other categories to roll with the punches and keep on going.

- Reconcile your accounts. [weekly] Check your bank balances against your budget (once a week if you’re just getting started) to make sure they agree and that you’re dealing with the truest picture of your finances. If the two balances don’t agree, record any missing spending in your account register until they agree.

- Assign money to categories every time money comes in. [every time you get paid] This is the really fun part. When money comes in, assign that money to categories. Maybe you need that money to cover the electric bill that comes out on 25th, or you have all your monthly categories covered so you can dump some into a savings category, extra debt payoff, or to get ahead in next month’s categories. Ask yourself “What does this money need to do before I get paid again?” and budget accordingly. Every time more money comes in, repeat!

Our Organize Your Finances Todoist template includes each of these recurring habits so you won’t forget.

Making a debt pay down plan

Paying off debt is the number one goal many people have when they first start budgeting, and we know how difficult it can be to start dealing with your debt. Often, folks feel so overwhelmed, they don’t know where to start. Thousands of YNABers have been there before and have come out the other side debt free.

Here’s a step-by-step guide on how to get yourself organized, choose a debt to focus on, and use your new budget to help you determine how much money you can put toward that focus debt.

1. List your debts and balances

This may sound like a very simple first step, but it’s often the hardest part! So many of us have been running from this debt monster for a long time, it can be really scary to turn and face it. But that debt is dark cloud hanging over your head whether you know how much it is or not. It’s always better to know the truth, so you can deal with it.

List out ALL your debts with their individual balances. Even if you’re not planning to pay them all off right now, list everything so you can see the big picture. Tally them up to get a total, and take a breath. You just made a big first step!

2. Choose your focus debt

Now that you’ve listed your debts, choose one to focus on until it’s gone. You’ll pay minimums on all the others and throw everything extra you can at the focus debt.

There are a lot of methods to choose a focus debt. We generally recommend the Snowball Method, which tells you to focus on the debt with the smallest balance first. That can be motivating when you’re first starting out, but it will depend on your situation.

You may also choose the Avalanche Method and go for the debt with the highest interest rate first. Or you may go with what we like to call the Anger Method and start attacking that debt that you feel like you’ve just got to get out of your life. Maybe it’s that loan to a family member or the debt on a car that your ex drives.

If you’re looking for a more detailed breakdown on the pros and cons of each method, check out this video.

3. Make a plan to prevent future debt

Before we go too crazy on paying off debt, I want to stress the importance of preventing future debt first. So many people fall into a cycle of paying off their debt only to find themselves right back in debt again when their car breaks down or some other “unexpected” thing happens.

To break this cycle of debt, it’s so important to first start saving for non-monthly expenses that like to sneak up on you (Step 3 in the first section above), so we can break our reliance on debt first. Make preventing future debt a part of your debt pay-down plan, and you’ll not only pay off the debt you have, but you’ll set yourself up to stay out of debt forever.

4. Determine how much money you can put to the focus debt [monthly]

This is where the budget you’ve made will help out a bunch. Once you’ve considered how much you need to save for non-monthly expenses and started tracking your spending, you’ll slowly build a solid idea of how much extra you have to safely put toward your focus debt.

This amount may change over time as you earn more income or cut back on other expenses. There will be seasons when you can really accelerate your debt pay down plan and seasons where you may need to step back. We recommend reevaluating the amount you’re sending to your debt monthly to make sure you’re putting everything you can afford toward it and not a cent more.

5. When you pay off your focus debt, evaluate your plan

Every time you pay off a focus debt, you’ll unlock some new monthly cash flow. The money that you were paying toward that debt is now in your control again! Take some time to determine what you’d like to do with that freed-up cash flow. Do you want to put it on the next debt? Maybe you want to beef up your non-monthly expense funds? Maybe you want to work on a savings goal? Whatever you choose is up to you! Once you’ve decided what to do next, choose a new focus debt, decide how much you’ll pay on it every month, and keep right on rolling! Oh, and don’t forget to celebrate, too! You’re making progress, one step at a time.

Putting your plan into action

Make this the year you fix your finances and finally experience that blissful control you feel in the rest of your life thanks to Todoist. Check out the Organize Your Finances template. It takes all the advice in this guide and puts it into a checklist you can mark as complete one step at a time. Plus, you’ll find lots of additional resources including free personal finance workshops and video courses to keep your money management momentum going.

Ready to get a handle on your money this year and finally free up that mental space? You’ve got nothing to lose, except all that debt and stress